For many, NET ZERO UK will be far too low a benchmark, particularly those that accept full or partial responsibility for their historic GHG emissions across their value chain. Going beyond NET ZERO UK or DEFRA’s GHG reporting protocols is much more likely to future-proof an organisation against the likely introduction of carbon rationing, predicted climate change trajectories and changing social attitudes. Narrowly defined net-zero benchmarks, such as NET ZERO UK or DEFRA’s, do not differentiate sustainable reductions to the global GHG in our atmosphere from those ‘off-balance sheeting’ these emissions.

The time horizon of any GHG accounts is also critical. Given the planetary climate systems are already on a warming trajectory, stabilising the concentration of GHG emissions at present levels – something that would not even be achieved with NET ZERO UK or DEFRA’s GHG benchmarks – only stops a bad situation getting worse.

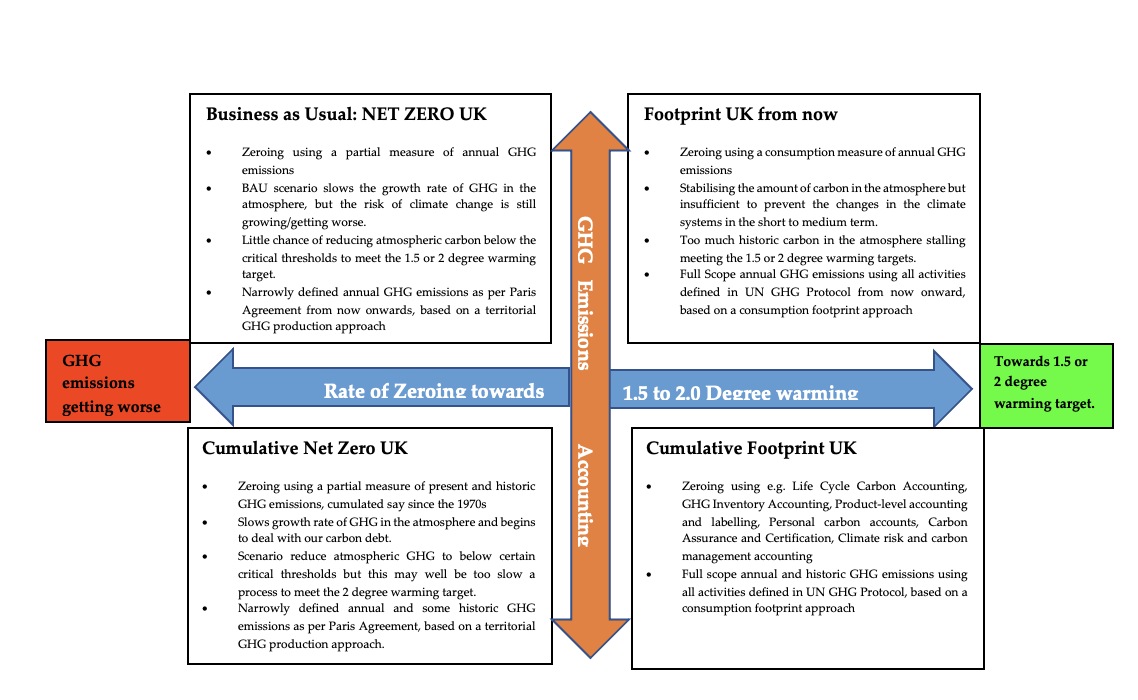

To illustrate this, we’ve identified four GHG accounting scenarios that quantify the emissions that need ‘zeroing’:

1. NET ZERO UK Narrowly defined annual GHG emissions as per Paris Agreement from now onwards, based on a territorial GHG production approach (which excludes the emissions of goods used that are imported, as well as international air travel).

2. FOOTPRINT UK FROM NOW Full-scope annual GHG emissions using all activities defined in UN GHG Protocol from now onward, based on a consumption-footprint approach.

3. CUMULATIVE NET ZERO UK Narrowly defined annual and some historic GHG emissions as per the Paris Agreement, based on a territorial GHG production approach.

4. CUMULATIVE FOOTPRINT UK Full-scope annual and historic GHG emissions using all activities defined in UN GHG Protocol, based on a consumption-footprint approach.

Scenarios 1 and 2 are variants of ‘net zero from now’, whereas scenarios 3 and 4 take into account the UK’s historic contribution to the GHG that are already in the atmosphere and likely to continue to blanket the Earth for the next 2,000 years. (Note: scenario 1 best represents the UK Government’s Net Zero strategy and targets.)

It’s also necessary to consider the social consequences of achieving net zero in the UK, because reducing carbon emissions isn’t just about avoiding climate collapse in the near future, but tackling social inequality now. While the air pollution associated with GHG emissions and climate change affect the health and environment of everyone, air pollution impacts the poorest most severely. The majority of the 8 million deaths each year from air pollution are in developing countries, which also have the least resources to cope with extreme weather events.

Moreover, notwithstanding that the increase in atmospheric carbon dioxide since the 18th century is attributed to the mass industrialisation of the affluent Western countries, the world’s richest 10% are still responsible for more than half of all GHG emissions through consumption today, while the poorest 50% create just 10%. The impacts of those emissions are felt unequally across countries with differing GDPs and across different income groups within a country.

Given this, it is somewhat paradoxical that the compliance with international climate change conventions is measured using protocols that do not account for the consumption of goods and services. They only measure the production of GHG within national geographical territories. This tends to under-represent the GHG impact of those living in richer countries and over-represent the GHG emissions of those poorer countries producing the goods the rich consume.

Much of this disparity comes about through an ‘out-of-sight-out-of-mind’ attitude to GHG emissions. GHG are largely invisible and their source difficult to prove, unlike physical waste such as plastic. There is no such thing as throwing ‘away’ a GHG. It all has to go into the atmosphere where it remains until it is removed and stored in natural carbon sinks. And while South East Asia might be far enough out of sight for the Global North not to worry about plastic pollution, the interconnectedness of life and its many systems – ecological, financial and socio-political – means we can never fully escape the consequences of emitting more than our fair share of GHG.

If governments and businesses keep playing pass-the-parcel with their climate change risks by exporting or outsourcing their GHG, we will not make sufficient inroads towards a net zero world. Even though creative GHG accounts may show we are making a difference, we are really stoking the flames for when the impacts of ‘off-balance sheet’ emissions return to bite governments, businesses and communities, whether directly or indirectly. Any net zero solutions or GHG accounting that doesn’t tackle climate risk holistically only passes the problem somewhere else along the chain and forward in time. And we are running out of space and time.